Swedish case study: What search data reveals about the impact of the pandemic on tourism

Visit Sweden, the Swedish government’s official tourism agency, has been working with Bloom Consulting and its sister company, D2 – Analytics, since 2015. Firstly, to understand the link between search data and tourism, and secondly, to help measure the impact of tourism strategies.

Normally, the country enjoys a steady flow of international tourists eager to experience its diverse natural landscapes and the ‘Friluftsliv’ lifestyle.

But, when the pandemic hit in 2020 and the industry came to a grinding halt, the government initiated a new analytics project to understand if the pandemic and Sweden’s “controversial” crisis management approach would change perceptions and tourism behavior, as well as to see how other destinations would be impacted.

Data on the domestic tourism market was also collected for the first time, allowing Visit Sweden to understand the size and behavior of the domestic market.

The use of D2 – Digital Demand © during the pandemic.

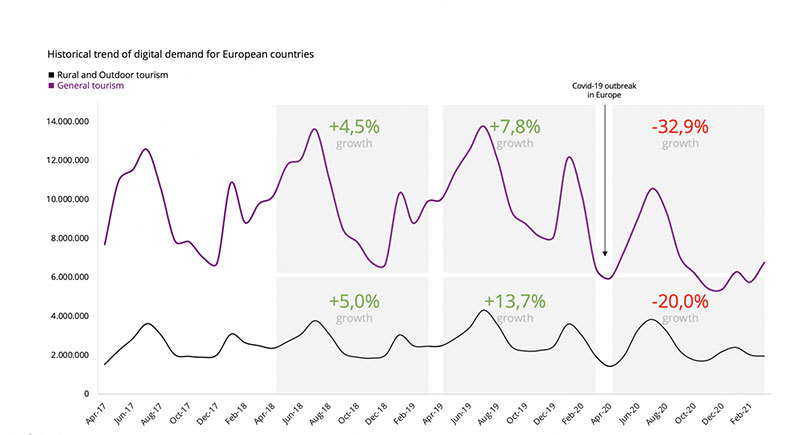

Over 100K+ tourism-related search terms clustered in 260 brandtags* (topics/themes) were fed into the D2 – Digital Demand © software, which tracks how often the terms are searched for and from where those searches are originating. This data has been compared against the country’s direct competitors over the last two years and across 10 other strategic markets.

“This is a fascinating project as we were able to evaluate not only the pandemic’s impact on tourist search behavior, but also on the recovery period which we are living through now,” said the Analytics division.

Bouncing back.

As countries open up and travel becomes more feasible, the data shows that the tourism industry is slowly showing positive signs of growth, predominately driven by the German, Dutch, and British market behavior.

D2 – Digital Demand © software results indicate that tourists were active online and eager to travel, particularly from countries such as the Netherlands and Denmark. In fact, these markets have been able to grow beyond pre-pandemic levels.

However, as revealed last year in the D2 – Analytics and Bloom Consulting COVID-19 study: The Impact on Tourist Behaviours, 15-35 percent of tourists still may not resume travel for leisure purposes in the medium term. This is despite governments easing travel restrictions and the EU’s broad-reaching vaccination program.

There is a new trend globally, for example, whereby more tourists are choosing cabins and private homes over hotels; and rural and outdoor activities over city trips.

Despite the general drop in interest, Sweden is recovering well compared to its peers. It is well-placed to benefit from unexpected consequences of tourism behaviours and preferences caused by the pandemic.

“Sweden is well-known for nature and outdoor activities, so tourism may grow faster than competitors as things open up. We will know more in the next few quarters when we look at the data that covers summer 2021,” our project partner, Bloom Consulting Place branding expert, said.

Importance of data.

Monitoring search data over time gives accurate and rich insights which can help shape a branding or marketing recovery strategy. As Sweden has done, taking a proactive approach can provide clarity even in unprecedented times and help a Nation Brand achieve its goals.

This article was initially posted on the Bloom Consulting website.

Contact D2 – Analytics at hello@d2analytics.io, +371 62102353, or book a free e-meeting to see the D2 – Digital Demand © software live presentation.

Other D2 - Analytics news and stories, you might be interested in:

April 25, 2021

Introducing NEW tool: D2 – Crisis Mode

April 8, 2021

D2 – Digital Demand ©, results may surprise you

January 4, 2021

Who’s managing the Digital Identity of nations and places?

May 27, 2020

New studies: Covid-19 impact on destinations

December 15, 2019

NEW product: D2 – Digital Supply software

September 23, 2017

New: D2 – Live Quanti software

March 12, 2015