D2 - Digital Demand ©, results may surprise you

Why should I care what people are searching for?

The economics of places begins with supply and demand, and today we will address the latter. Our proprietary software, D2 – Digital Demand ©, works to assess a place’s real appeal and attraction and measure the performance of brand strength across the five dimensions of the Bloom Consulting Nation Brand Wheel ©; investment, tourism, talent, prominence, and exports. Think, what can you learn about a place by calculating the number of searches concerning tourism, let’s say, against its decided benchmarks? How important would it be to understand which brandtags are most sought after digitally within the dimension of talent? Does it speak to the success of your institution that throughout COVID-19, searches for investment remained steady or even increased in 2020?

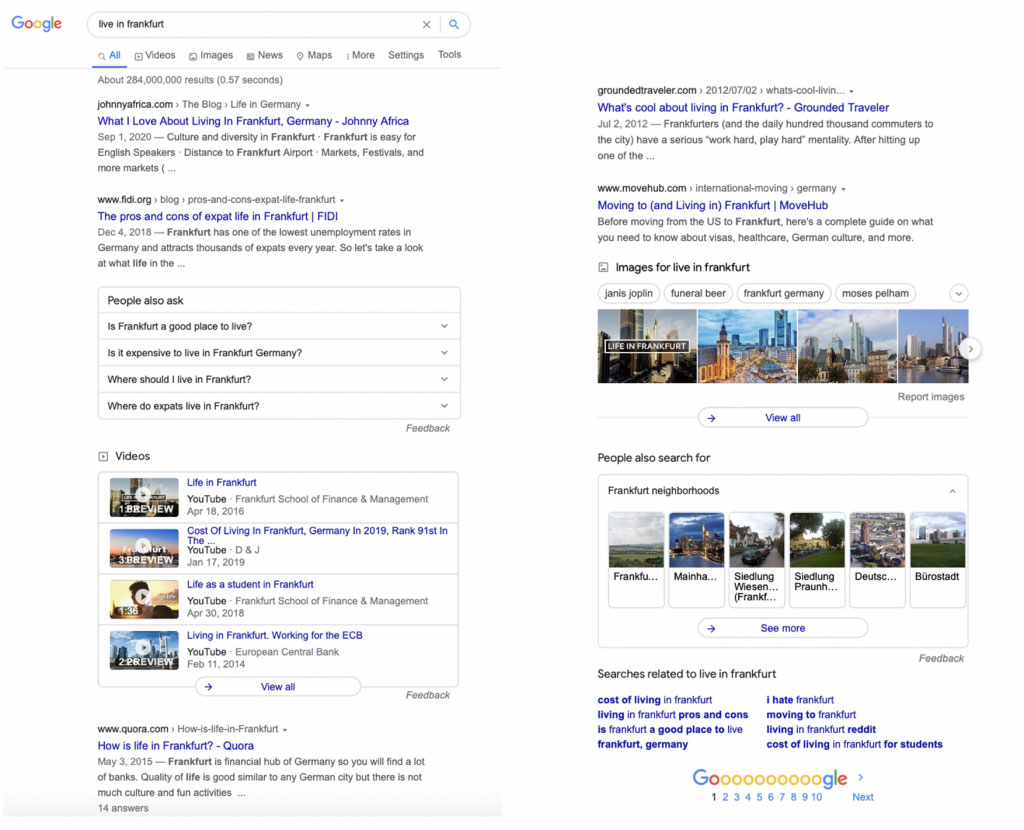

Let’s first look at why D2 – Digital Demand © digital search analytics tool is a significant contributor to the assessment of international perceptions. D2 – Digital Demand © software works in conjunction with Digital Identity. Digital Identity is, in essence, the first five pages of results found when you search for yourself (a place) online. These results undoubtedly curb the way consumers rate their opinion on visiting, working in- or buying from a place. D2 – Digital Demand © tool is not a result of Digital Identity. Rather, Digital Identity is the place brand touchpoint with which those who perform a search are influenced and formulate images, whether positive or negative.

A study by D2 - Analytics sister company Bloom Consulting concluded that 86% of investors start searching for information about potential investment opportunities by using search engines as a primary source of information. There is no firewall to hide behind. Once someone becomes provoked to learn more about your country, region, or city, it only takes a search.

— Jose Filipe Torres, Founding Partner and Strategy Director of D2 - Analytics, CEO of Bloom Consulting.

Connecting the dots: likeability, search volume and results.

The first source of results we will look at is the comparative volume of searches for a place and its benchmarks by dimension. We can conclude whether a place is more or less relevant by the sheer mass of searches within each area of focus. How so? If a place has in its mind that it is well-known for its tourism offer, stakeholders may be overestimating its competitiveness in terms of real demand. Search volume would determine whether competitors are doing better in terms of actual interest and engagement and how they are perceived. International perceptions could confirm that global markets think highly of a place. Still, search volume analysis will show whether the global community is proactively interested, or in other words, putting their search where their mouth is.

We would be hard-pressed to say that the average traveller planning their vacation doesn’t begin with, or at least eventually, search for their desired destination to optimise their experience once on the ground. To top it off, those who receive the most searches have a greater search to execution ratio, whether it be hotel booking, study abroad program, or business investment.

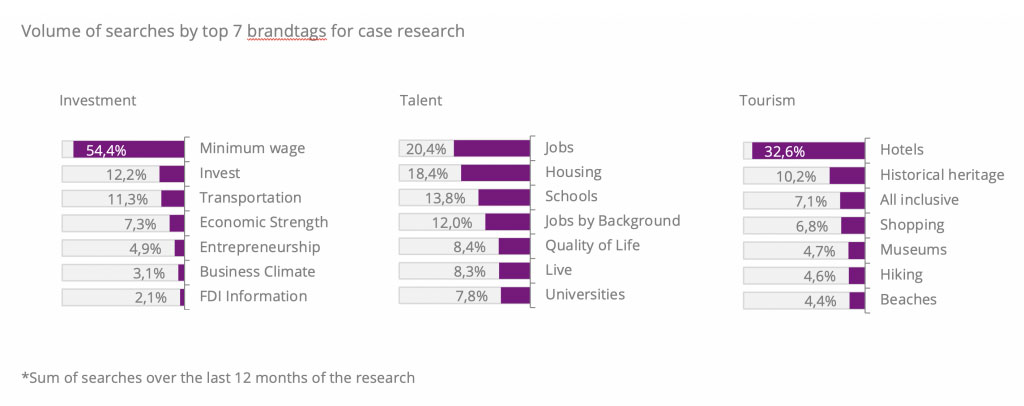

The power of search results by brandtags can tell us which areas of focus are performing most proportionately in terms of digital appeal and the reality of the offer. In other words, are people searching for relevant information and is the content being shown relevant to the place. Brandtags work as determinants in what people search for by country, region, or city, while digital supply assesses the content displayed.

In looking at a specific geographic location, parallels can be drawn between demographic and psychographic factors and their corresponding brandtag searches by volume, more greatly elaborated in the upcoming section. What is really of interest to whom? Places depend on relevant information being found when searched online. For example, when searching for “live in Frankfurt” on Google, the Google search results were as follows (see the print screen below). The influence which provoked this search could have come from countless sources. The demand, however, led to finding these results (supply), which now have the power to determine whether this individual decides to pursue a life in Frankfurt.

D2 - Digital Demand © software: What is of real interest about a place?

Within the dimension of talent, it is vital to understand whether there is a skills gap going unaddressed and is thus affecting the appeal for Foreign Direct Investment (FDI) and impacting tourism development opportunities. The economic gain in understanding who is searching for what may be the key to unlocking a wealth of untapped domestic potential from neighbourhoods to the national level. Likewise, gathering data that highlights international searches for your place is a tool of measurement in gauging whether actions, activities, or policies are taking hold in the minds of global citizens and sparking a real interest in your country, region, or city.

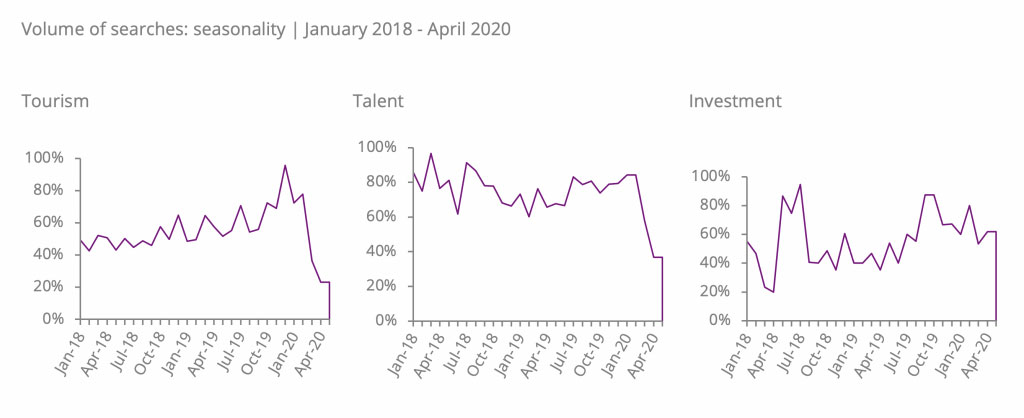

D2 – Digital Demand © software breaks down the effects of seasonality in global searches for individual dimensions. At any given time, this tool effectively sheds light on monthly trends such as tourism planning periods and annual growth rates of talent attraction. Trend behaviour is deduced when organic searches occur. In other words, there is no one-off event driving results and skewing data. Reading into consumer behaviour, we can see when considerations for purchases are being made precisely during the year. Similarly, this speaks to investment search periods that may not follow such an easily anticipated annual pattern but show growth (or decline) nonetheless.

COVID-19 waved goodbye to most trending behaviours projected for 2020. We have seen in certain cases; however, the dimensions of tourism and talent have nearly fallen off the chart in terms of searches around March and April, but another story could be told for investment. While investment patterns are often more erratic, the spontaneity in this year’s trend was that search volume was only slightly affected, if at all (search results are limited to specific countries, regions, or cities and not a global average). Reckoning the possibility that this phenomenon has anything to do with the seamlessness of online services offered by a country, region, or city for FDI, we’d venture to say that there are models available in the global market which other place leaders would benefit from to maintain the inflow of investment during restrictive times.

D2 – Analytics digital search analysis tool D2 – Digital Demand © can analyse any country, region, or city search volume, topics of interest, search seasonality, target market preferences, benchmark competitors and more! Let us know if you’re interested in scheduling a call and seeing the software presentation: hello@d2analytics.io or +371 62102353.

Other D2 - Analytics news and stories, you might be interested in:

April 25, 2021

Introducing NEW tool: D2 – Crisis Mode

January 4, 2021

Who’s managing the Digital Identity of nations and places?

May 27, 2020

New studies: Covid-19 impact on destinations

December 15, 2019

NEW product: D2 – Digital Supply software

September 23, 2017

New: D2 – Live Quanti software

March 12, 2015